Organizing a Private

Capital Raise

A private capital raise involves many moving parts, from formation to onboarding and capital calls. DealPoint simplifies the process so you can focus on your investors.

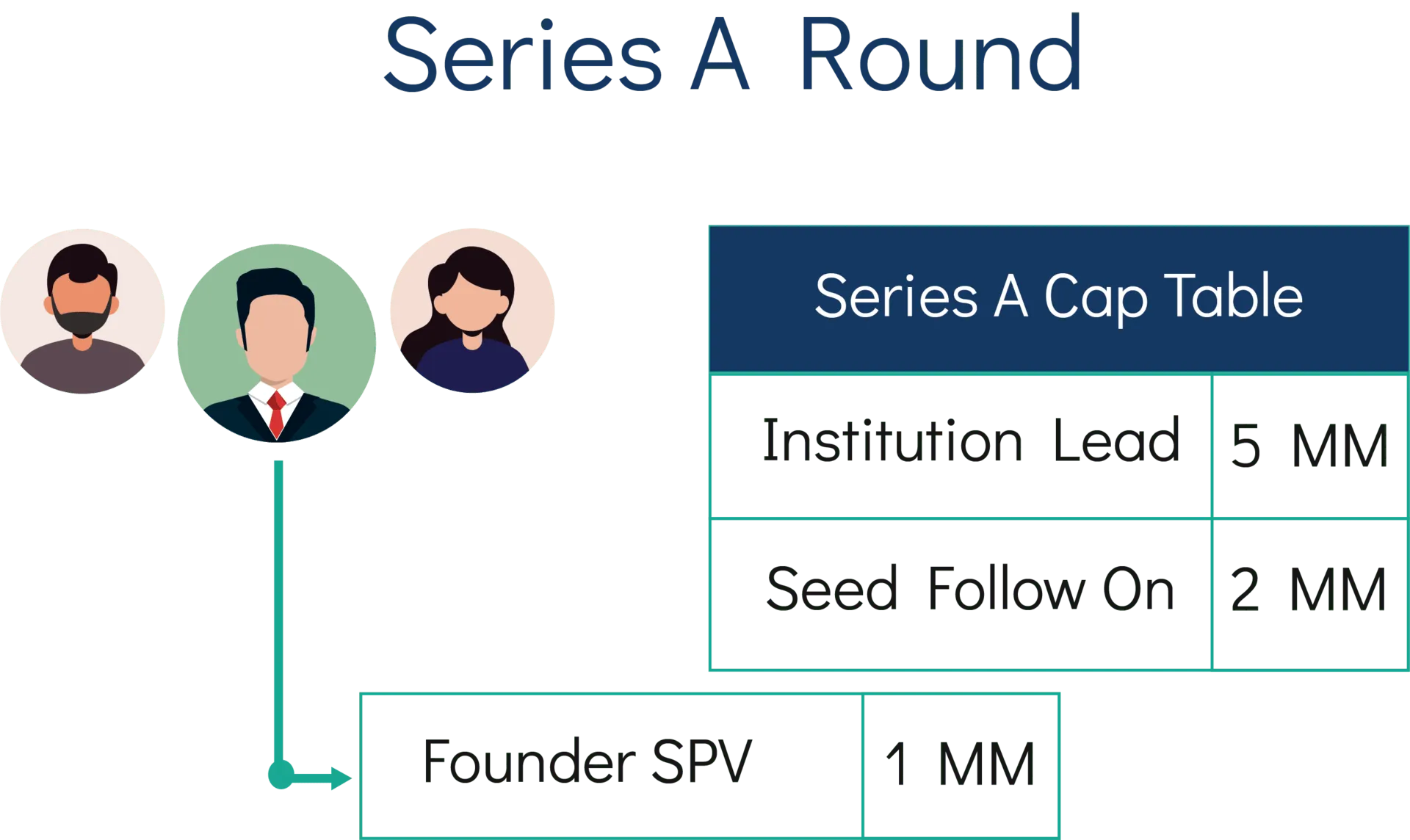

Options tailored to your specific capital raising requirements

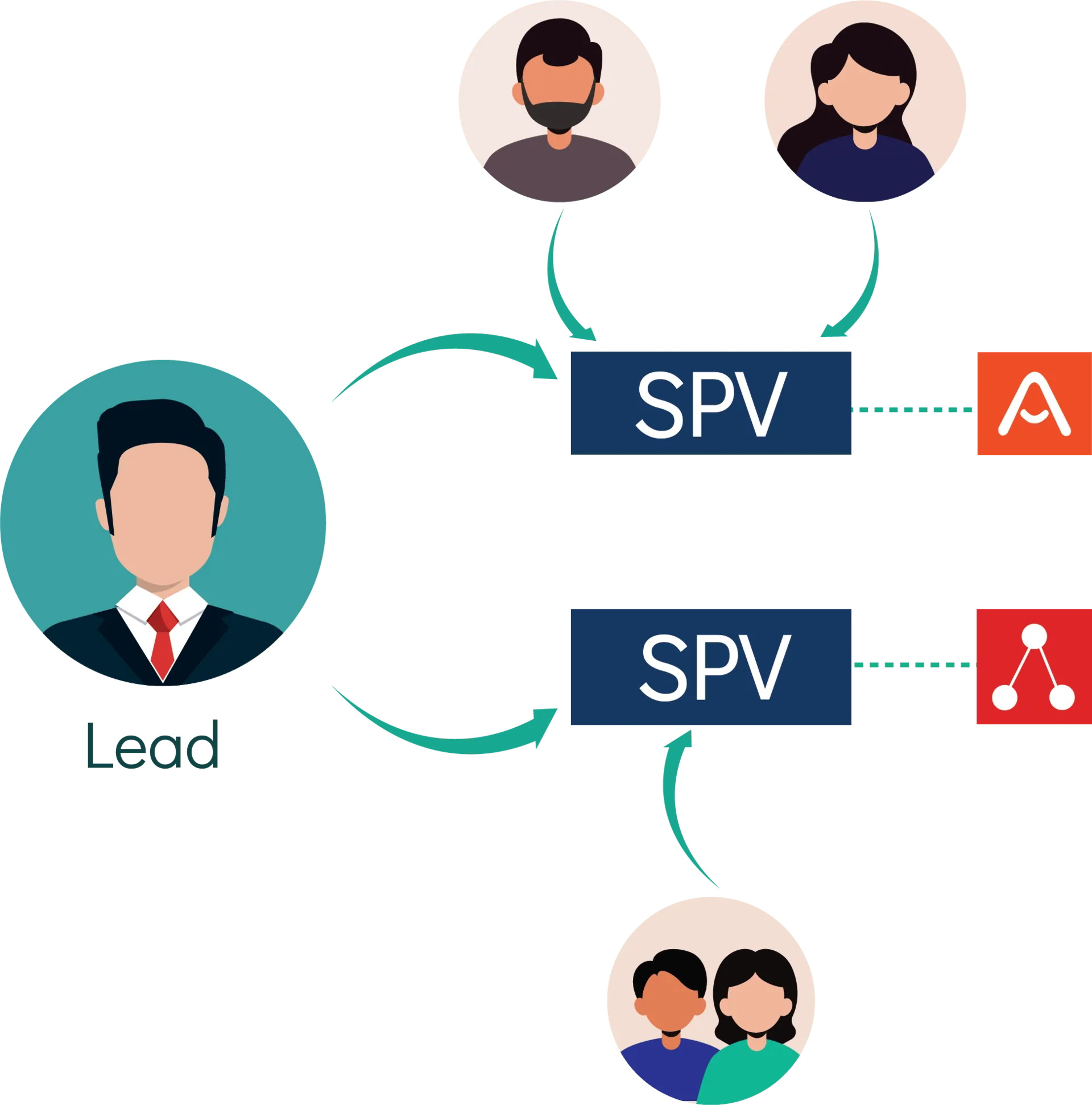

Learn more about setting up an SPV

Close your funding round efficiently & accurately

Benefits for you

Turnkey setup covering formation, data rooms, onboarding, and managed legal and accounting.

A consolidated view of all investors and their activity, tracked through to close.

Transact funds securely through online pre-authorized debit transfers.

Benefits for your network

Seamless access to data rooms and onboarding, anytime, on any device.

View all investment documents and updates in one self-serve Investor Dashboard.

Support for individual, joint, and corporate investors, across all accreditation types and single or multiple deals.

Case Studies

"We used to spend a lot of our time correcting subscription agreements, going back and forth with our investors. I like that the software generates the right documents - talk about saving time and reducing investor frustration. Also, since Covid-19 we are now processing close to 100% of our subscriptions this way. It is so much more efficient, cost effective and makes it more user-friendly for the investors as well."

"Dealpoint has helped us transform our business from handling dozens of private trades per month to hundreds per month. The process flow leaves little room for error, allowing our representatives and compliance personnel to focus on the issues, not missed signatures. In our last regulatory audit, even the regulators said they loved Dealpoint!"